高级财务经理

20-35万/年北京市硕士不限经验

职位描述

岗位职责:

1.End-to-End Coordination and Support of Global Projects

全球项目端到端协调和支持

- Support global project leaders in the execution of transactions (acquisitions, restructuring, asset transfers. Company reorganization projects and financing projects etc.). Involved in all stages of the process from to post closure integration, with a focus on ensuring adherence to Chinese regulatory standards, especially focusing on valuation related process.

持全球项目负责人执行交易(收购,重组,资产转让)。公司重组项目、融资项目等)。参与从并购到并购后的所有阶段,重点确保遵守中国监管标准,特别是估值相关流程。

- Work closely with internal teams (Finance, Legal, Compliance, Strategy) and external advisors (accounting firms, law firms, etc.) to ensure alignment with corporate governance standards. shareholder expectations and Chinese regulatory frameworks, particularly those related to SASAC (State-owned Assets Supervision and Administration Commission)

与内部团队(财务、法务、合规、战略)和外部顾问(会计师事务所、律师事务所等)紧密合作,确保符合公司治理标准。股东期望和中国的监管框架,特别是与国资委相关的监管框架。

- Support global project leaders to monitor project timelines, resolve bottlenecks, and drive timely delivery of critical deliverables (e.g., due diligence, audits, valuations and legal etc.).

支持全球项目负责人监控项目进度,解决瓶颈,并推动关键交付成果的及时交付(例如,尽职调查,审计,估值和法律等)。

2.Regulatory Filing & Approval Processes

法规备案和批准流程

- Coordinate the preparation of documents required for SASAC and other regulatory filings, including audit reports, due diligent reports, valuation reports, and legal documentation etc., ensuring accuracy, completeness, and adherence to regulatory frameworks.

协调准备国资委和其他监管文件所需的文件,包括审计报告、尽职调查报告、估值报告和法律文件等,确保准确性、完整性和遵守监管框架。

- Compile and submit filing andapproval packages (feasibility studies, audit reports, due diligent reports, valuation reports, and legal documentation etc.) to shareholders, coordinating cross-functional reviews for compliance.

编制并向股东提交文件和审批包(可行性研究、审计报告、尽职调查报告、估值报告和法律文件等),协调跨职能审查以确保合规性。

- Track filing and approval progress, address regulatory queries, and refine submission strategies to optimize approval efficiency.

跟踪归档和审批进度,解决监管问题,完善提交策略,优化审批效率。

- Manage SASAC ownership registration processes, including document submissions, system filings, and post-approval compliance.

管理国资委所有权登记流程,包括文件提交、系统归档和审批后合规。

3.Compliance, Risk Management & Policy Implementation

合规,风险管理和政策执行

- Interpret and implement SASAC, MOF (Ministry of Finance), and cross-border regulatory policies (e.g., Regulations on the Supervision and Administration of State-owned Enterprise Asset Transactions).

解释和执行国资委、财政部和跨境监管政策(如《国有企业资产交易监督管理条例》)。

- Identify compliance risks (anti-monopoly, foreign exchange controls, national security reviews) and collaborate with legal teams to design mitigation strategies.

识别合规风险(反垄断、外汇管制、国家安全审查),并与法律团队合作设计缓解策略。

- Optimize internal workflows and documentation templates based on post-project reviews to enhance team efficiency.

根据项目后评审优化内部工作流程和文档模板,提高团队效率。

4.Stakeholder Engagement & Relationship Management

利益相关者参与和关系管理

- Serve as the key liaison between shareholders, overseas regulators, and senior leadership, ensuring effective communication.

作为股东、境外监管机构和高层领导之间的重要联络人,确保有效沟通。

- Prepare executive briefing materials and support high-level discussions with regulatory bodies or decision-making committees.

准备行政简报材料,支持与监管机构或决策委员会的高层讨论。

- Manage external advisor performance, cost-effectiveness, and the quality of their work, while ensuring they meet the company's expectations.

管理外部顾问的绩效,成本效益和工作质量,同时确保他们满足公司的期望。

任职要求:

1.Master’s degree in Finance, Accounting, Economics, or related fields. Professional certifications (CPA, CFA, ACCA, Certificated Appraiser in China) are highly preferred.

金融、会计、经济或相关专业硕士学位。专业认证(CPA, CFA, ACCA,中国认证估价师)优先考虑。

2.5+ years in corporate finance, investment banking, or transaction advisory, with direct involvement in the cross border M&A life cycle.

5年以上企业融资、投资银行或交易咨询工作经验,直接参与跨国并购生命周期。

3.Proven track record in managing 3+ state-owned enterprise (SOE)-backed M&A/reorganization projects, including successful navigation of SASAC approval processes.

管理3个以上国有企业并购/重组项目,包括成功通过国资委审批流程。

4.Prior experience in central SOEs, multinational corporations, or overseas projects is a strong plus.

有央企、跨国公司或海外项目工作经验者优先。

5.Expertise in financial modeling, valuation methodologies (DCF, comparable company/transaction analysis), and deal structuring.

财务建模、估值方法(DCF、可比公司/交易分析)和交易结构方面的专业知识。

6.In-depth knowledge of CAS, IFRS, and SASAC regulatory frameworks.

深入了解CAS, IFRS和国资委监管框架。

7.Advanced proficiency in Excel (complex modeling), PowerPoint (executive-level presentations) and Word.

熟练使用Excel(复杂建模)、PowerPoint和Word。

8.Exceptional cross-cultural communication skills to manage global stakeholders in English and Mandarin.

出色的跨文化沟通能力,以英语和普通话管理全球利益相关者。

9.Fluent in both Mandarin and English (written and spoken), capable of drafting bilingual reports and supporting international negotiations. French is a plus.

流利的中英文(书面和口头),能够起草双语报告并支持国际谈判。会说法语尤佳。

10.Results-driven with the ability to thrive in high-pressure environments. Meticulous attention to detail and risk-awareness.

以结果为导向,能够在高压环境中茁壮成长。对细节一丝不苟,有风险意识。

11.Willingness to undertake frequent short-term overseas travel (e.g., due diligence, regulatory meetings).

愿意承担频繁的短期海外出差(例如,尽职调查,监管会议)。

12.Collaboration: Demonstrates strong teamwork abilities and fosters positive working relationships with diverse teams and stakeholders in a remote way .

协作:展示强大的团队合作能力,并通过远程方式与不同团队和利益相关者建立积极的工作关系

13.Communication: Effectively communicates complex ideas with clarity and ease, ensuring smooth interactions with both internal and external parties.

沟通:清晰、轻松地有效沟通复杂的想法,确保与内部和外部各方的顺利互动。

14.Project Management: Displays excellent organizational and time management skills, with a proven ability to drive projects forward and meet deadlines in a dynamic environment.

项目管理:表现出出色的组织和时间管理能力,具有在动态环境中推动项目前进和按时完成任务的能力。

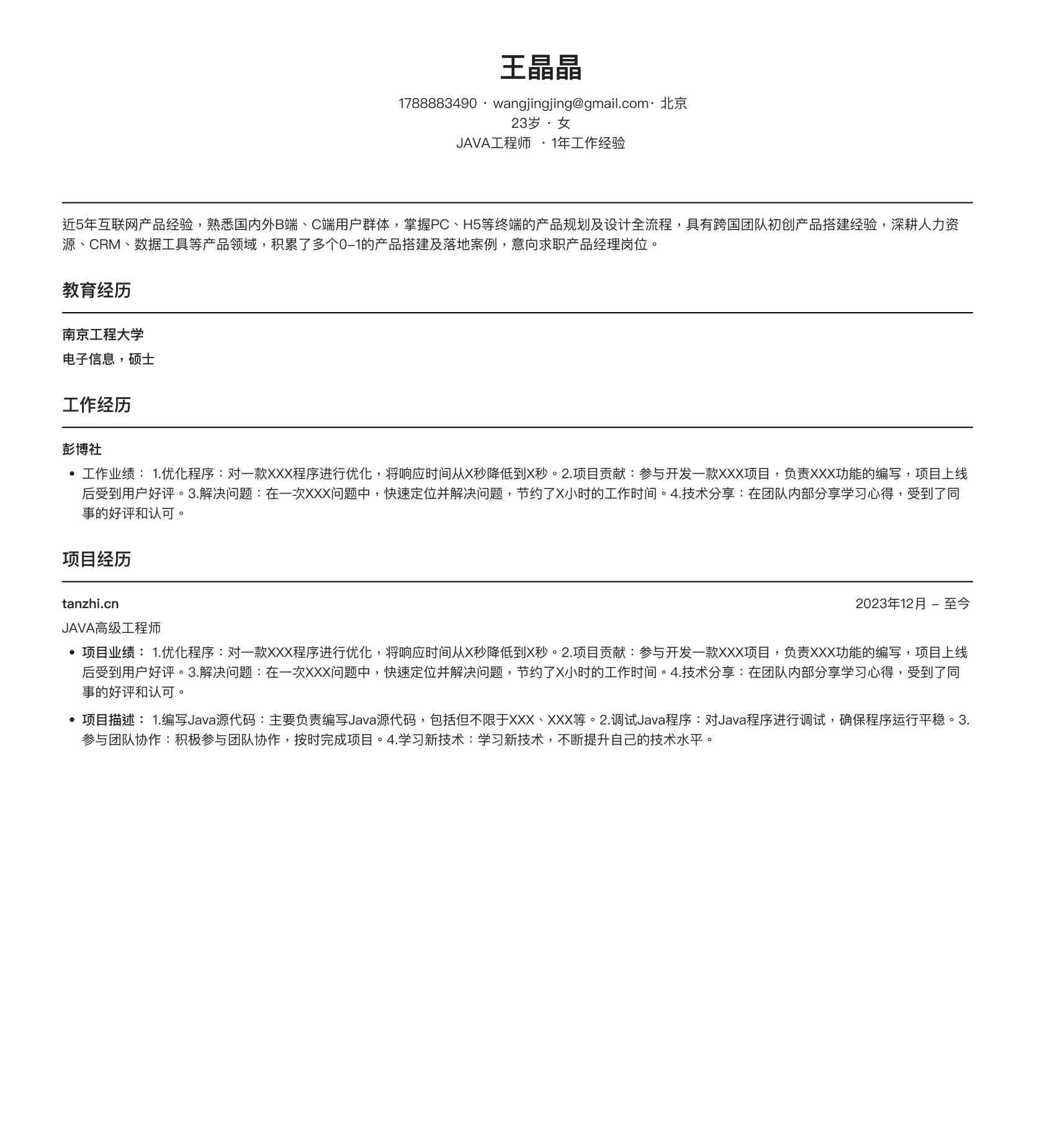

简历是否与目标岗位匹配?

为什么没有面试?我的简历有什么问题?

怎么优化?职业优势在哪里?

投递之前...

你的简历真的准备好了吗

80% 简历因职业定位模糊,表达无焦点

被快速跳过,立即诊断,提升面试机会!