税务专员

1.3-1.7万·13薪苏州市本科不限经验

职位描述

Main Tasks & Responsibilities /主要工作职责

- In charge of the daily taxation administration. Keep close communication with local Tax Bureau. To be responsible for monthly declaration of VAT,VAT refund, stamp duty, education surplus, and quarterly and annual corporate income tax.

负责日常税务管理。 与当地税务局保持密切沟通。 负责每月申报增值税,增值税退税,印花税,教育费附加,季度和年度企业所得税

- To give valuable advice on tax savings and highlight any impact on operations with regarding to changed tax regulations.

提供并及时宣讲税务法规变更对运营的影响

- Summarize the latest tax regulations & rules on a monthly basis and update to the department members.

每月汇总最新的税收法规和规则

- Corporate with logistic to well manage the export custom forms to avoid cost impact.

和物流部合作完成进出口手册和报表

- To assist audit on tax area.

协助完成税务相关审计

Requirement / 任职要求

- University Bachelor 本科学历

- Rich Tax policy knowledge 丰富的税务政策知识

- Qualified taxation certification 税务资格证优先

- Strong MS office skill 强大的办公软件技能

- Rich experiences in tax policy 丰富的税务政策知识

- More than 3 year experience in taxation 超过最近3年的税务工作经验

- Strong taxation experience on Importing & Exporting & Golden tax system 具有进出口税务系统和金税系统经验

- Good reading English 良好的英语阅读能力

- Good team work spirit 良好的团队合作精神

- Good communication skill 良好的沟通技能

- Be good at using MS office in financial analysis and presentation 擅长使用办公软件进行财务分析和展示

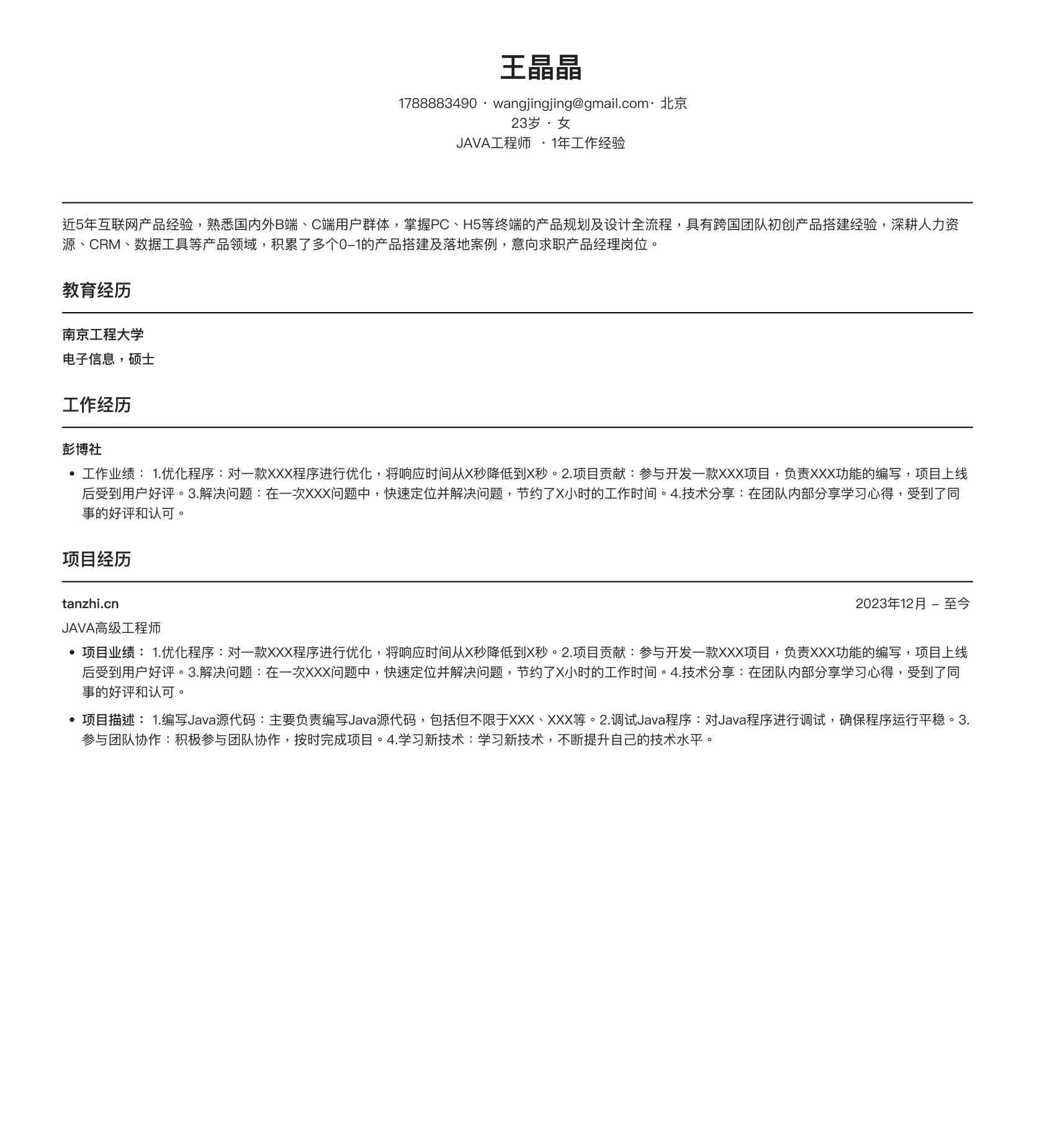

简历是否与目标岗位匹配?

为什么没有面试?我的简历有什么问题?

怎么优化?职业优势在哪里?

投递之前...

你的简历真的准备好了吗

80% 简历因职业定位模糊,表达无焦点

被快速跳过,立即诊断,提升面试机会!